“But how much have you saved for retirement?”

That’s the question you should volley back in response to someone boasting how she paid off her entire student loan debt in only two years. Because while conquering student debt rapidly may provide a psychological win, it is often penny wise, pound foolish; coming at the expense of long-term financial security.

Instead of striving toward the wrong version of success – fast payoff – recent graduates should assess their financial priorities holistically and think twice before paying off student loans ahead of schedule.

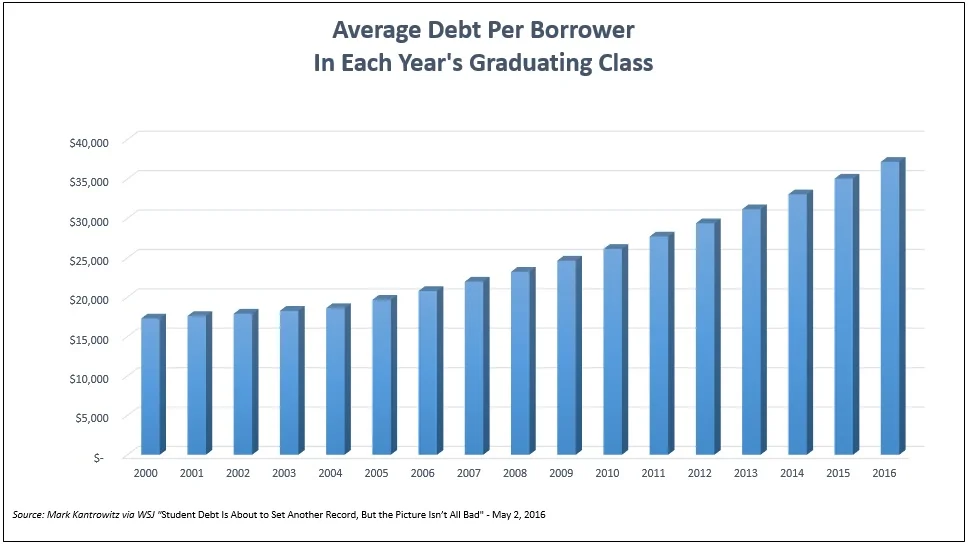

With student debt on the rise, the decision of how to pay off loans has never been more crucial. The average student loan balance has increased by more than 78 percent since 2006 according to data compiled by Mark Kantrowitz, a higher education expert. In fact, the Class of 2016 will graduate with the highest amount of student debt in history, an average of $37,172 per borrower.

The burden is even heavier for those finishing a graduate program, especially newly minted lawyers and doctors.

The latest comprehensive statistics show 86% of law school students graduating with debt, with the typical borrower owing $140,616. Similarly, 87% of medical and health science students graduated with debt in 2012, with a typical borrower owing $161,772.

Much of the attention in recent years has understandably been directed at reducing defaults and ensuring that borrowers understand the various repayment plans available, including qualifications for the four income-driven plans known as Income Based Repayment (IBR).

The Consumer Financial Protection Board (CFPB) recently unveiled a “Payback Playbook” it plans to release to help graduates avoid distress with student loans. As CFPB Director, Richard Cordray, put it, "borrowers have the right to choose among different plans, but they need to know what their options are. They need better information."

But the need for better information extends well beyond identifying the right repayment plan. Many graduates would benefit from increased guidance on how to manage student loan debt in the context of other financial goals, like retirement savings.

With a monthly student loan payment that can resemble a second rent payment, it is easy to understand why young alumni are anxious about their debt and fixate on reducing their burden quickly. Many mistakenly believe it is better to divert extra money to their student loans; however, with few exceptions, recent graduates should prioritize retirement savings over accelerated student debt repayment.

Jake Spiegel, a senior research analyst at HelloWallet, and his colleague, Scott Cooley, director of policy research at Morningstar, explain why in a recent report titled, “Two’s a Crowd: Are Retirement Savings Being Crowded Out by Student Loans?” The researchers modeled different scenarios for young workers who had a certain percentage of their income earmarked as discretionary and used it for either retirement savings or for paying down a student loan ahead of schedule.

Source: HelloWallet Report “Two’s a Crowd: Are Retirement Savings Being Crowded Out by Student Loans?” March 2016

They then calculated the net wealth of individuals at the moment their loans were paid off as well as at age 65 and concluded that “workers are most often best served by contributing extra dollars to their retirement plans, and not paying off student loans ahead of schedule, particularly if their employer offers a match on retirement savings.”

Spiegel and Cooley’s analysis accounts for several factors that could come into play when deciding whether to focus on student loan repayment or retirement savings: the amount of the loan, the amount of disposable income an individual has, the interest rate on student debt, the investment return, and the match rate for retirement contributions. In most cases those who concentrated on retirement savings over student loan repayment came out ahead in the long run.

The HelloWallet paper is significant because it is one of the first to quantify the economic benefits of focusing on retirement savings rather than accelerated loan repayment. A closer look at some of the factors involved can help explain why this is true.

Free Money

Many employers will match your contributions to a retirement plan, often with a $0.50 or $1.00 match for every $1.00 you put in, up to a certain percentage of your salary. For example, suppose your salary is $40,000 and your employer has a 50% match up to 5% of your salary. If you contribute $2,000 into your retirement account, your employer will match that contribution by depositing $1,000 into your account.

This translates to a 50% guaranteed return on your contribution, putting more in your pocket in the long run than putting an extra $2,000 toward your student loan balance. If your company doesn’t match retirement contributions, the recommendation is similar, but the explanation is more nuanced (see Insight #5 for details).

Key Insight #1: If you are lucky enough to work for a company that offers a match, it is a no-brainer to contribute extra dollars to your retirement plan instead of diverting them towards student loan payments, at least until you take full advantage of the free money.

The Compounding Penny

Imagine you had a penny that doubled in value each day for a month. How much would you have on Day 31? The answer may surprise you. You would have over $10 million.

Now suppose your friend was lazy and didn’t pick up his penny until Day 2. How much would he have on Day 31? A little more than $5 million, or half of what you had. As Yoda might say: “A big difference, one day makes.”

I use this thought experiment in the personal finance classes I teach to introduce the importance of saving early for retirement. It helps illustrate the value of compound interest, what Albert Einstein is rumored to have called “the most powerful force in the universe.” While money in your retirement account won’t double every day, it will double several times before you retire.

You can use The Rule of 72 to help estimate how many years it will take for your money to double: Divide 72 by how much you expect your money to earn each year. For example, if you expect money you invest in your retirement account to earn 6% each year on average, then your money will double every 12 years (72 divided by 6).

Key Insight #2: To get an extra “doubling” of your account – the equivalent of your penny going from $5 million to $10 million – you have to start earlier. It is the early contributions that matter the most, even if they are small, because they have the most time to compound and grow.

The Catch-Up

The other lesson to be learned from the penny example is how hard it is to catch up if you procrastinate. Suppose you had a third friend who was really lazy and didn’t collect her initial penny until Day 10. She would have less than $21,000 on Day 31. For your friend to catch up to you, she would need to start with $5.12 on Day 10. That may not seem like much given the low values, but imagine using $100 instead of a penny at the start. To begin on equal footing on Day 10, she would need to start with $51,200. Yikes!

Key Insight #3: Delaying early retirement savings to pay off more student debt may seem attractive in the short run, but is quite costly in the long run because it will be harder to catch-up on savings later.

The Tax Deduction

If you contribute to a standard retirement account, like a 401(k) account, you receive a tax benefit that reduces your tax burden at the end of the year. The value of the benefit will depend mainly on your tax bracket, which for many recent graduates ends up being 15% to 25%.

Perhaps counterintuitively, paying off your student loans faster could actually increase your tax burden because interest on student loans is typically deductible. Specifically, student loan interest is an “above-the-line deduction’ for singles with a modified adjusted gross income up to $80,000. According to the HelloWallet report, it “provides an additional, though minor, incentive to prioritize retirement savings.”

Key Insight #4: The tax-advantaged status of retirement accounts and the ability to lower your tax burden by deducting student loan interest are additional reasons to funnel extra funds towards retirement and not your loan balance.

An Exception to a Common Rule

There is one other insight from HelloWallet’s analysis worth mentioning because it contradicts this simple rule of thumb that many well-meaning financial experts tout: Compare two interest rates or rates of return on investment when deciding which to prioritize. This rule works well when the rate differences of the two options are large in magnitude.

For example, retirement contributions that get matched by an employer, and provide a 50% guaranteed return easily dwarf the single digit interest rate on most student debt.

This rule also works well with an apples-to-apples comparison of two options with the same type of rate. For example, after making your minimum payment, it is most cost-effective to divert extra funds to pay off a 28% high-interest credit card debt first before tackling a 5.8% interest rate student loan balance.

However, the rule of thumb can lead you astray when the differences in rates are smaller, time horizons vary greatly, and you are making an apples-to-oranges comparison. If you look closely at the third and fourth scenarios in the HelloWallet table, you’ll notice that retirement savings won even when the interest rate on student debt was higher than the projected investment return on retirement contributions (7% interest on student debt versus 5% investment return).

When I asked Spiegel via email where an extra dollar should go after maximizing the employer match, he said that “particularly for young workers with long time horizons, the net wealth-maximizing strategy is [still] to allocate that discretionary dollar to a retirement account – a dollar that has, for example, 40 years to compound in the market is more valuable than a dollar used to pay down a loan with a 20-year term.”

Key Insight #5: Even after you are maximizing your employer’s retirement match and even if the interest rate on your student debt is higher than the rate you expect your retirement savings to earn, you are still better off concentrating on retirement contributions over student debt repayment in all but the most extreme cases.

Faster is not always better. While the desire to shed the albatross of student loans swiftly may be appealing, the peace of mind that comes with being debt free is hardly worth the cost of your long term financial security. Retirement may seem far off, but consider investing your penny in it today.