Asking recent graduates where they’ll be in five or ten years can be its own form of cruelty. Some may return a quick answer and others a blank stare. In any case, the question is central to another often-stressful topic: How to handle student debt.

In a previous post, I analyzed one dimension individuals should consider when evaluating whether to refinance student loans: the potential savings. However, it is equally important to consider the benefits that federal student loan repayment options offer and evaluate the likelihood that you will want or need to utilize them.

You have more choices today to tackle student loans than ever before, including the option to refinance with private companies like CommonBond, SoFi, Earnest, and First Republic. In addition to determining whether you qualify for private refinancing and calculating your potential savings, it behooves you to weigh these questions before deciding to refinance:

The two key dimensions to consider before refinancing your student loans are the potential savings and your risk tolerance or degree of certainty in your current situation

1) Am I comfortable giving up the benefits and protections of federal student loans?

The potential to save thousands can be enticing, but you should give serious consideration to whether the savings outweigh the benefits and flexibility that federal student loan repayment options afford. For example, if you have federal undergraduate loans and decide to attend graduate school, your loans can enter deferment so you don’t need to make payments while you are studying and potentially without a source of income.

For example, if you have federal undergraduate loans and decide to attend graduate school, your loans can enter deferment so you don’t need to make payments while you are studying and potentially without a source of income.

This option isn’t generally available with private companies that refinance your student loans (It should be noted that some companies have begun trying to mimic federal benefits and provide graduates with some protections. SoFi, Earnest, and CommonBond, for example, all have programs to pause payments if you are unemployed).

2) Would I save more under any of the federal student loan repayment options?

While the government’s student loan system is needlessly complex to navigate, the most meaningful benefit of its programs, such as Public Service Loan Forgiveness (PSLF) and income driven repayment plans, is the potential to reduce graduates’ monthly payments and ultimately forgive a portion of their loan balance. These options disappear if you refinance in the private market and should not be discarded in haste. (If you need help evaluating the merits of different federal repayment options, I would recommend NerdWallet’s question-based guide created by Brianna Mcgurran and Teddy Nykiel.)

PSLF is especially attractive for those who qualify because of the shorter repayment time-frame (120 required monthly payments), the ability to make non-consecutive payments, and because the forgiven balance isn’t taxable. You might be surprised by who may qualify for PSLF. For example, many doctors who graduate and work at non-profit hospitals – including many academic hospitals – may qualify. A recent Brookings Institute report found that 25 percent of the American workforce qualifies under PSLF.

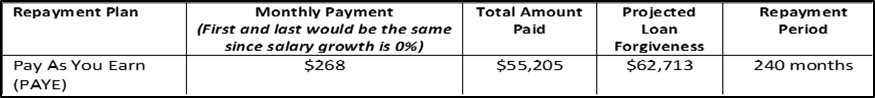

Repayment options such as Pay As You Earn (PAYE) and Income-Based Repayment (IBR), may be advantageous because they cap monthly payments and leave more cash in a graduate’s hands. Moreover, part of the loan balance may ultimately be forgiven after a certain repayment period, resulting in tremendous savings (It is important to remember and prepare for the fact that in most cases, the forgiven balance is treated as taxable income). Finally, if you are unemployed, you may find that your payments under the income-driven repayment plans are $0.

Each program has its own nuances, which are important for a borrower to understand and consider. For example, REPAYE considers not only your income, but also your spouse’s income, even if you file taxes separately, while PAYE only considers your income. Additionally, once you opt for and are approved for one of the repayment plans, make sure to read all the ongoing requirements.

Ron Lieber of The New York Times recently highlighted troubling cases of individuals who were initially told by the Department of Education (DOE) that they qualified for PSLF, only to be told years later that the DOE had changed its mind.

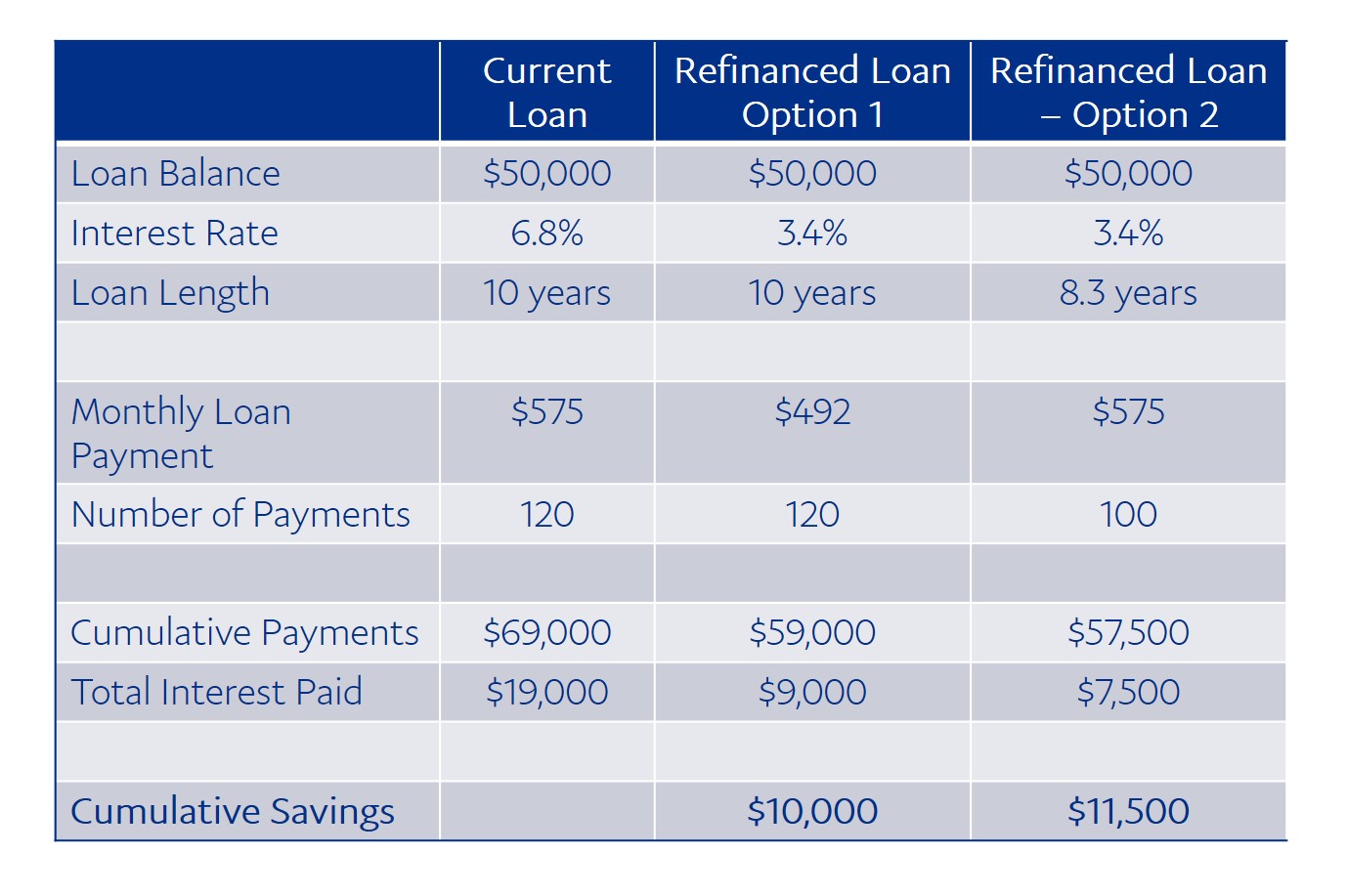

In my last column, I gave a hypothetical example of someone starting to repay a graduate school loan of $50,000 with a 6.8% interest rate and a standard 10-year (120 month) repayment term. I showed how loan refinancing could hypothetically save the graduate over $10,000 (chart replicated below).

Before pulling the trigger on private refinancing, evaluate options against savings from federal income-driven repayment options.

To this table, we would want to add columns showing the details of the various income based repayment methods. The Federal Student Aid Office, part of the Department of Education, offers a repayment estimator to help one decide between various repayment plans. The estimator asks you to input information about your loans (loan type, interest rate) and yourself (tax filing status, family size, state of residence) and spits out a table showing monthly payment amounts as well as the total one would pay over the life of the loan and the project loan forgiveness.

Unfortunately, this table is highly misleading and could easily lead you down a sub-optimal path. To understand why, you need to ask yourself another important question:

3) How realistic is it that my salary will dramatically increase?

The federal loan calculator uses a questionable assumption that your salary will grow 5% each and every year over the course of repayment. To the DOE’s credit, it does include a conspicuous link to “What assumptions do we make”; however, it doesn’t allow one to change the assumptions. Furthermore, the salary growth information is buried among a sea of text and is easy to miss or simply ignore, despite being so consequential.

How consequential? Suppose your starting salary is $50,000. If it grows 5% annually, your salary in 25 years would more than triple to $169,318. I wish everyone reading this column that kind of salary growth, but unfortunately, it isn’t necessarily realistic for many industries, job functions, and life circumstances. Therefore, using the government calculator could lead someone to make a sub-optimal choice about refinancing.

It may help to walk through a concrete example to illustrate how impactful this assumption is in making a decision about what repayment plan or refinancing option to choose. Let’s continue with the example of a New York resident who has an adjusted gross income of $50,000, a current direct unsubsidized loan balance of $50,000 with a 6.8% interest rate, and a single tax filing status.

Here is what the government website would calculate with its 5% annual salary growth assumption:

The Department of Education online calculator returns potentially misleading results for repayment options because it assumes annual salary growth of 5%.

Now, let’s take an extreme case and assume annual salary growth of 0% and see how that changes the repayment decision for PAYE. I created the table below using the inputs from the calculator at Student Loan Hero, which unlike the government website, does allow you to change the salary growth percentage.

As you can see, there are huge implications to the assumption you use. If one haphazardly plugs her information into the government website, she may assume that there is negligible benefit to using the federal programs over refinancing with a private lender when, in fact, someone with little expected salary growth, might gain tremendously from an income-driven repayment program like PAYE.

The table below illustrates that, if a graduate were to assume 0% salary growth, the PAYE option is superior not only to the standard loan repayment option, but also to the private loan refinancing option (note that I am not factoring in the tax payment at the end of the loan term on the forgiven balance, which would be treated as taxable income).

The savings opportunity of the Pay As You Earn (PAYE) income-driven repayment option will heavily depend on the salary growth assumption used.

It can be difficult to predict exactly how and when your salary will grow over the years, but to generalize, the lower your starting salary and the slower you think your salary may grow, the more likely it is that federal programs will save you money. The benefits of federal income based repayment options are strongest according to Tuition.io, a firm that offers an employer-funded student loan contribution platform, “for people pursuing lower-wage jobs (such as public service), people with high debt-to-income ratios and people who are unemployed or underemployed.”

4) How comfortable am I that my situation won’t change in the near future?

Source: 123RF/alphaspirit

You also want to consider your current job situation, especially how confident you are that you will stay in the same job or career field or maintain the same income level. For example, I’ve had many friends who took high-powered law firm after finishing law school. Some are still climbing the proverbial corporate ladder, on the cusp of making partner. Others decided very quickly that it wasn’t for them and moved to other jobs that they were more passionate about, but at significant lower salaries. If the latter had rushed to refinance loans before making a drastic career change, they might have found themselves struggling with the long-term implications of that decision, continuing to pay back loans under terms that only made sense when they were making three times as much.

Will refinancing increase or decrease your flexibility to change jobs? Will you be able to afford your monthly payments with your new salary? If not, what options do you have? In some cases, this uncertainty won’t change your decision about whether to refinance and instead influence your financial planning strategy.

5) Do my salary and lifestyle allow me to create a cushion in case of an unexpected shock?

If you are able to create a sizable financial reserve, you may be able (and willing) to tolerate more risk and uncertainty around your student debt. This reserve is a function not only of your income, but also of your cost of living.

Source: 123RF/6kor3dos

If you are living paycheck to paycheck and don’t have slack in your budget, you may not want to take on additional risk by refinancing and forgoing the flexibility of federal loan repayment. On the other hand, if you have created a financial plan that enables you to put money aside, you may be more comfortable taking on uncertainty and refinancing. This latter case could apply to the individuals I described earlier who took high-powered law firm jobs after school and may find it easier to put aside sizable amounts.

Putting It All Together

With the answers to all these questions, you will fall into one of four quadrants. The top-right and bottom-left quadrants are more straightforward.

Locating where you fall on this 2x2 matrix could help you determine whether or not you should refinance your student loans

If your savings potential and degree of certainty are both high, you should probably refinance. Conversely, with low potential savings and low certainty, you are probably better off sticking with your current federal loans until something changes.

The other two quadrants are more nuanced, especially the top left. What should you do if your potential for savings is high, but your degree of certainty/risk tolerance is low?

While each individual situation varies, I’d suggest focusing on the following:

- What is the root cause of your low certainty?

- Are there options for you to mitigate the uncertainty or risk?

For example, perhaps you are starting out your career in the public sector. If your uncertainty stems from losing access to PSLF and other federal repayment options, it will be harder to mitigate this risk. You may want to hold off refinancing for at least a few years until you have a better sense of whether you will stay in the public sector or not. If you do stay, then you can work on making the requisite 120 payments to qualify for non-taxable loan forgiveness. If you decide to leave for a job that does not qualify for PSLF, you can then reconsider refinancing.

You would also want to consider how far along you are in making the 120 payments and therefore how much in loan forgiveness you’d be giving up if you left the public sector. If you’ve already made 110 payments and have a large loan balance, it may make sense to wait until you make the final 10 payments before switching jobs.

Alternatively, perhaps you’ve started in a high-flying corporate career with a six-figure salary and your uncertainty stems from apprehension about how long you will stay in that field and whether you’ll be able to afford the monthly payments on a lower salary at another job. Here, you may be able to mitigate this risk through smart financial planning as well as through refinancing your loan for a longer time frame to lower monthly payments. For example, you could direct the savings from refinancing into a separate account that will give you a cushion to continue making monthly payments if you switch jobs. This is a feasible alternative for those, like the law school friends I mentioned earlier, who want to pocket the savings from a lower interest rate, while maintaining career flexibility.

The bottom-right quadrant is a different story. Taken to an extreme, and from a purely rational perspective, if you are 100 percent certain in your situation then you would refinance even if the savings were $1 (for econ majors, let’s ignore all transaction costs here, which may include an individual’s time spent refinancing). However, I’d argue that one’s situation is never truly 100 percent certain and it is probably worth establishing a threshold of savings before you refinance.

There’s one final question that I would challenge anyone considering refinancing to answer in advance:

How will I use the money?

Source: 123RF/Wavebreak Media

Ideally, refinancing can save you thousands and create additional slack in your budget; however, it is vital to have a plan for what to do with those extra dollars. Be purposeful and strategic about how you use your savings (e.g., emergency fund, retirement savings, down payment for a house). Remember that student loans must be considered within the context of your other financial priorities and obligations.

The beauty of refinancing at a low interest rate is that it can make it easier to reach multiple goals simultaneously. For example, as I argued in a previous article, even with most single-digit interest rates on debt, millennials are often better off prioritizing retirement savings over accelerated repayment of student loan debt. Refinancing at a lower interest rate can help tip the scales, enabling you to achieve both student-loan payoff and long-term financial security.